There are some occasions in which you purchase items with cash or on your personal account. You want to record them so you can write off the expense. These transactions can be entered into QuickBooks® with a journal entry or you can setup a bank account called petty cash.

Journal entry method:

1. Click on Company from the Main Menu and click on Make General Journal Entry.

2. Choose the account the expense was for. In the Debit column type in the amount of the purchase. Enter a memo regarding the purchase. If you are using classes in QuickBooks® don’t forget to enter a class.

3. You will credit the Owners Draw or Draw account the total of your debits.

In the Chart of Accounts you will want to have an account for money you put in and take out of the company. This could be called Owners Draw or Draw. They type of account it would be is an equity account.

Petty Cash Method

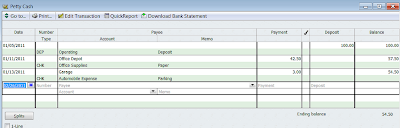

Another way to handle cash transactions is to setup a petty cash bank account. For example, let’s say you have $100.00 in petty cash. When you need to buy something you take it out of petty cash and put in a receipt. First setup a bank account called Petty Cash.

1. Click on Chart of Accounts from the Home Page.

2. Click on Add new from the Account button.3. The type will be Bank Account.4. The name will be Petty Cash.

When you write a check from your regular checking account for petty cash you will choose the Petty Cash account as the account. This will put money into the petty cash register.

Now that you have a petty cash account you can enter the receipts you have that you paid for with cash or through your own account. The main difference is that you don’t have to put a check number.